Q2 Investment Review & Outlook 2018

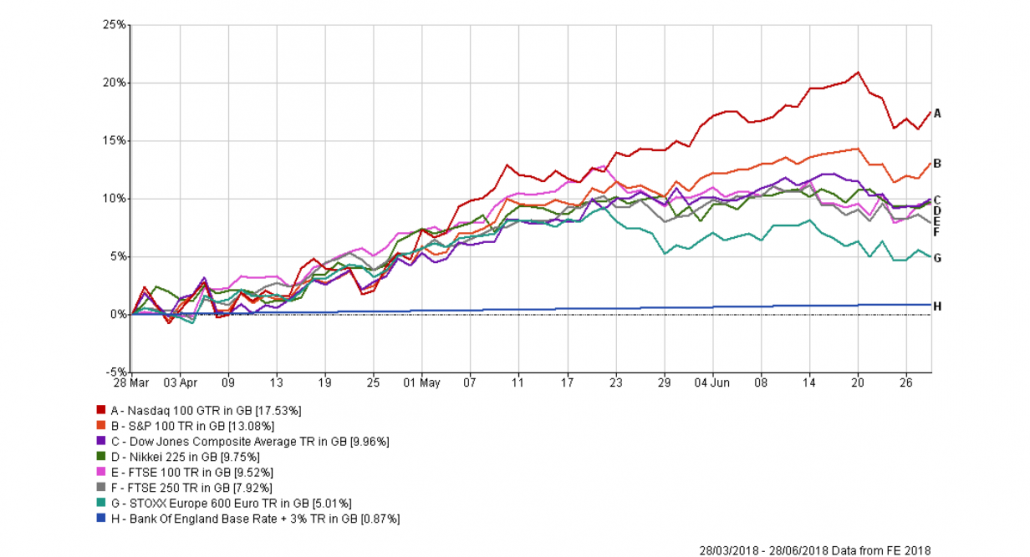

Market complacency has been somewhat dispersed during the 2nd quarter of the year. Having printed a new all-time closing high on the FTSE of 7859.17 latterly the market has eased back nearly 4%. With new highs in the equity market being followed by almost immediate retracements the return of volatility serves to highlight the short termism shown by some investors.

The reason for the initial rally in global indices was based on a combination of factors namely, the initial welcoming of US – China trade talks, commodity prices reacting strongly on this, easing of geo- political tensions with North Korea and the earnings cycle evidencing strong growth. In addition, the commodity rally has propelled lacklustre mining and oil companies to new relative multi-year highs.

Recently risk assets have found themselves on the back foot, as political risks combined with Fed hikes, slower non-US growth and a reduction in dollar liquidity served to dent confidence. Short-term volatility should not be a concerning issue, as long-term investors this temporary mispricing can afford a more attractive entry point to gain exposure to key themes that become discounted to fair value. Much of this macro turbulence has been instigated by President Trump’s frequent and confusing tweets. More apparent is the worst-case scenario Trump suggests, only to then reign in the narrative when required. With US mid-terms approaching in November the strategy appears to be aimed at garnering support and the focus on China seems to be, for the moment, one way to achieve that. In our view it is classic game theory.

Closer to home progress seemed to be made on Brexit negotiations coupled with elections in Europe that showed change was welcome and investors viewed this as a positive change. Even though the FTSE rally was extreme, we highlight the influence of the drop-in sterling (GBP is down 6% vs. USD over the period) which provided a boost to mining and oil stocks, in addition to a rise in underlying commodity prices. We do appreciate that the move in the FTSE did not result in a broad-based rally given that outside the overseas earners, domestic pressures continued.

Europe

Similar to the performance of global markets Europe also tailed back towards the end of the quarter. Having started the year strongly the drop off can be attributed to a few key factors; the surprise result in the Italian election, ECB stimulus easing, auto weakness (post Daimler results – highlighting impact of Trump tariffs) and weaker PMI prints. Underperformance was largely due to the shift in interest rate differentials and drop off in new orders and data pointing towards EU market cap debt-to-GDP near 63% which is close to a post crisis high. Many strategists have questioned the timing of ECB policy normalisation and the effect trade tensions will have on the Eurozone. We take comfort that European earning revisions have turned positive during times of uncertainty relating to elections and negative headlines on inflows. We have witnessed over the last 3 months that growth is picking up helped by higher commodity prices, stronger FX and earnings revisions moving higher. The auto sector (Daimler profit warning) and talk concerning the taxation of internet company profits were the main catalysts for the drop into the end of the quarter but typically these are only short-term detractors.

US

Headlines have been dominated by the ratcheting up of trade war rhetoric and the potential tariff changes make for uncomfortable reading as investors speculate on the severity and impact they may have. These are not isolated to China but now involve Mexico, EU, Canada and other trading partners. This lack of coherent policy was one of the reasons for the market weakness in Q2. We still doubt that Trump’s trade manoeuvres will result in the type of war that could derail global growth or meaningfully impact on inflation, but that is very much the consensus view, too, and perhaps we are all being complacent, especially with mid-terms on the horizon and votes to be won.

The US economy appears to be in rude health, boosted by a consumer sector that’s benefitting from real income gains. Only recently have the key reforms started to filter into earnings and the macro landscape. The post-tax valuation rerating should take place, resulting in earnings revisions upgrades, easing of regulatory headwinds and rate hike expectations. Since the end of Q1 US companies have continued to conduct large amounts of share buybacks, propelling the earnings upgrade cycle that included repatriation of overseas funds (potentially as much as $1.2trillion). Net inflows continue to show support for US equities over the last 3 months and is expected to continue given the business-friendly environment. If the Fed become more hawkish then the USD is likely to move higher (typically negative for Emerging Markets), resulting in a drop-in commodity prices and weaker International US corporate earnings. In addition, we have now to accommodate, and understand in the face of improving corporate earnings, the impact of statements from President Trump that negatively affect sentiment. We have seen this in terms of tariff talk, sanctions and trade wars.

China

Recent data points from China showed evidence of stabilisation evidencing growth of 6.8%, real estate pricing appreciation and still leaving more scope for RRR (Reserve Requirement Ratios) cuts which will be market supportive. The main headlines focus on tariffs from both the US and China. With the US running a near $370 billion trade deficit with China, these headlines are making the market nervous as it’s difficult to identify (and quantify the impact on) what areas or sectors could be next as there is no coherent approach to trade policy from the US.

If this continues with no progress being made, then it has the potential to derail global growth as investors look to move money into different sectors. The US announcement of a 25% tariff of $50bn worth of Chinese goods followed by a $50bn tariff of US exports by China will continue to give the market concern. Furthermore, the US Trade Representative’s office is being asked to find an additional $200billion worth of Chinese goods to tax at 10%, we do expect a response from China but exactly what is yet to be seen. In terms of the immediate impact some analysts have trimmed growth forecasts by only 0.1% -0.2%, not enough to make a significant impact as yet. As the year progresses this could turn out to be, alongside the Sino -US trade dispute and sanctions, a larger concern – simply by reducing demand for Chinese products.

Into the last few days of the trading quarter we heard comments from Trump regarding curbs on Chinese investment and tech exports to China. Trade tensions currently are heating up and the reply to this was another RRR cut to stem the pressures from US actions (the second this quarter, 25 April and 24th June). RRR cuts have more impact on the domestic market but shows that this still is a key market barometer on global macro.

Japan

Whilst Japan’s macro and political picture is noisier than it was 12 months ago, company fundamentals remain robust. Corporate Japan has experienced a strong reporting season with plenty of upside surprises versus company forecasts, particularly in terms of dividends – Fiscal year 2017 was the fourth consecutive record year of increasing shareholder return. Company earnings grew by c 22% in the fiscal year ending March 2018. The Japanese economy is in good shape. Although eight consecutive quarters of GDP growth, the longest streak in the last 28 years, was recently broken by a -0.6% print for Q1 2018 in what is known to be a volatile series subject to future revisions. From a bottom up perspective Japan is working – export volumes look robust, and although the strong Yen has its challenges, it is not considered to be a dramatic issue (the stronger Yen has boosted unhedged returns). At the company level, there has been a pick-up in CAPEX as well as an increase in wage inflation. In addition, there are several upcoming positive drivers of tourism (2020 Olympics and 2019 Rugby World Cup) that should deliver further growth potential.

UK

Despite the recent all-time high on the FTSE, outside the overseas earners (most of which are ‘old industries’ and/or vulnerable to disruption), domestically we see more pressure on the local market. Profit warnings continue, retail pressures, company closures and restructuring happening on a daily basis. Consumers spending on the high street is under pressure, debt levels high, income stalling – all pointing towards a tough time for the UK. UK growth has slowed but at a slower level and as we have mentioned throughout this update – Brexit remains the key risk.

Earnings growth in the UK market continues to be lacklustre, with depressed valuations being one of the key reasons we are witnessing fervent M&A activity. With the drop-in sterling led by confusing outcomes for Brexit playing into activist’s hands by way of picking up domestic companies at significant discounts to fair value. With almost daily headlines on Brexit negotiations there is still no real progress. Investors remain nervous until we see tangible evidence on key negotiating topics namely the withdrawal agreement, customs union, Northern Ireland border control, no clarity of a transition deal leading to hard Brexit. Until then it’s remains tricky to quantify the impact of the outcome that may or may not include European market accessibility.

| Equities | Fixed Income | Alternatives & Specialist |

| The earnings story remains positive for global equity markets. Growth metrics globally in the equity space remain sound, moderate inflation and an end of central bank easing, in addition to a rate hiking environment, should not be seen as universally negative for equity markets. Equities continue to show evidence of strong balance sheets, increases in dividends, M&A (cross border, blockbuster and domestic) activity.Within Europe it remains a value play with strong earnings, upward guidance revisions and low debt in the latest earnings season. Much of the macro risk (Italian/ German elections) should now be priced in (though the ultimate impact of any long-standing tariffs is, as yet, unquantifiable) and provide both a macro risk rebasing and drop off in volatility.

In the UK Brexit risk continues to be the overhang. We do see that in the event of a UK market drop on the outcome it will be stemmed by BoE action and a drop in GBP. As this is an unknown, we must await developments.

Key risks will remain around trade tariff and trade wars, slowdown in China / global growth, central bank policy mistakes (hiking rates and shrinking balance sheets seen as a headwind for equities), rate differential sensitivity – namely Fed normalising, BoJ/ECB remain in cautious mode. |

Equities still represent good value vs. fixed income – when medium-term rates rise they will inevitably cause bond prices to fall and real capital losses will be hastened by inflationary forces. We are also very concerned by the lack of liquidity across fixed income markets.Against this backdrop we struggle to find opportunities with attractive risk/reward upside.

For fixed income to outperform normally it is preceded by a global macro event or political crisis.

|

Our exposure to alternatives still has a bias towards listed infrastructure assets selected through a strict valuation process which also seeks to consider other non-investment (i.e. political) risks.Our remaining Commercial Property exposure is expressed through Pan-European portfolios that provide exposure to the changing retail distribution landscape through the type of assets that they own. |

Summary

Q2 proved to be another turbulent quarter for global markets led by several factors which we have highlighted. It therefore appears that global macro and geo-political topics and events will continue influence the direction of markets in the short-term with central banks now on a pre-defined course, politics – protectionism, Brexit, European tensions – all likely to continue to set the market tone over the summer. It is clear that we no longer have a market environment where almost anything could be construed as ‘good news’ for markets (either because it really was good, or because it was so bad that policymakers would step up with more monetary relief). We are moving into a new era of market dynamics as Central Banks start to reign in monetary support leaving investors to speculate on whether company earnings will be able generate sufficient growth after the crutch of QE has been removed. Understandably concerns remain as to the vulnerability of a global economy (that is burdened with record debt levels) to even modest increases in interest rates.

Outside of global macro and geopolitical concerns we continue to follow the progress of, and provide exposure to, companies that are progressing to be the dominant players (and suppliers to) the industries of the future. The impact of new technology on incumbents is still making significant progress. Disruption continues to be one of the key themes and will involve the application of progressive technologies across a diverse group of industries, sector and sub-sectors (Artificial Intelligence (AI), Electric Vehicles (EV’s), Cloud Computing, Virtual and Augmented Reality (VR/AR), Cyber Security, FinTech and Healthcare). We have a particular focus on how these companies can monetise product offerings by capitalising on the changes taking place.

To conclude we take the view that synchronised global growth remains favourable, albeit at a slightly slower rate. We see volatility becoming more prevalent however, we also regard such market swings as an opportunity to reposition when short-term investor sentiment enables us to take advantage of mispricing.